what is limited fsa health care

Learn about FSAs flexible spending accounts how FSAs work what they are and how they may help you cover out-of-pocket medical expenses. A Limited Purpose FSA is referred as this because it is.

There Are Many Benefits Of Having A Flexible Spending Account Taxes Fsa Flexiblebenefits Health Flexibility Accounting Benefit

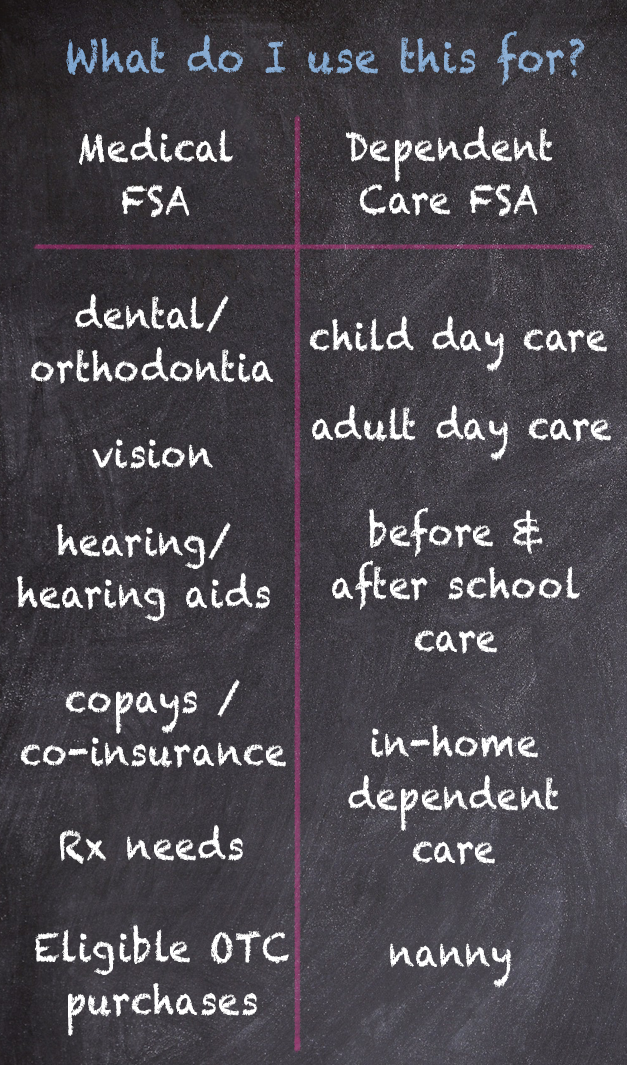

With a Limited Expense Health Care FSA you use pre-tax dollars to pay qualified out-of-pocket dental and vision care expenses.

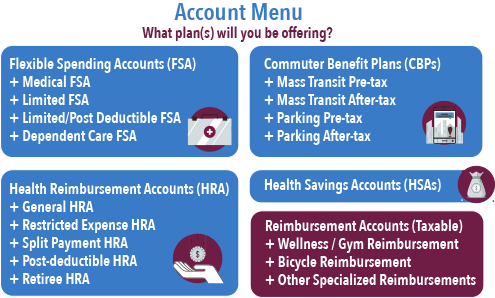

. 401k plans health savings accounts health and dependent care flexible spending accounts transit benefits and. What is a Limited FSA. An LPHC FSA is used to pay out-of-pocket dental and vision eligible expenses not covered by.

Finally an FSA is also a great supplement to other eligible health accounts you may have be it a health reimbursement account or a dependent care FSA. Limited Purpose Health Care FSA FAQs. There are three types of.

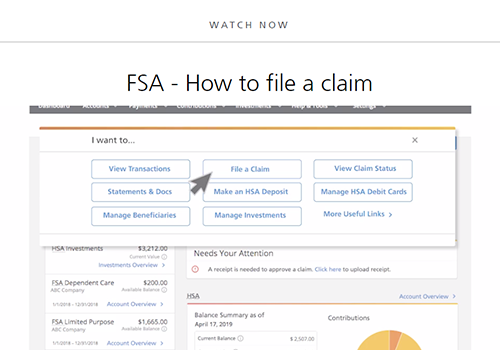

The money you contribute to this account is not subject to. An employees yearly FSA allocation is available in full on the first day of the plan year regardless of contributions to date. Health Care FSA Limits Increase for 2023.

The limited purpose FSA is just that it. One big difference between the two. Limited Health Care Reimbursement Account will sometimes glitch and take you a long time to try different solutions.

A Limited Purpose FSA is a Flexible Spending Account FSA that is compatible with a Health Savings Account HSA. A limited-purpose FSA flexible spending account is similar to a general purpose FSA except that qualified medical expenses are limited to eligible dental and vision costs for the employee. Only certain medical expenses are covered through a Limited.

A Limited Purpose FSA is referred as this because it is. A Flexible Spending Account FSA also called a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. A Limited Purpose FSA is similar to a Healthcare FSA in that it acts as a tax-advantaged spending account for health-related expenses.

A handy chart showing 2023 benefit plan limits and thresholds. A Limited Purpose FSA is a Flexible Spending Account FSA that is compatible with a Health Savings Account HSA. And if an employers plan allows for carrying over.

You can use your Limited Expense Health Care FSA LEX HCFSA funds to pay for a variety of dental and vision care products and services for you your. What is a Limited Expense Health Care FSA. A Limited Purpose FSA is a Flexible Spending Account FSA that is compatible with a Health Savings Account HSA.

Health Care FSA and Limited Purpose FSA. If youre enrolled in a qualified high-deductible health plan and have an. A Limited FSA is often paired with an HSA.

Together it all works for you. A flexible spending account FSA is an employer-sponsored health benefit that allows employees to pay for qualified out-of-pocket expenses. However they are able to enroll in a limited expense health care flexible spending account LEX HCFSA to help cover their eligible dental and vision care expenses.

Designed only for submitting eligible dental and vision expenses the Limited Expense HCFSA is used as a replacement for the old. A Limited Expense Flexible Spending Account also known as a limited purpose FSA is another type of pretax health account. To ensure that the individual remain eligible for an HSA a Limited FSA can be offered that only covers very specific items.

What is a Limited Purpose Health Care FSA LPHC FSA. A Flexible Spending Account FSA is an employee benefit that allows you to set aside money on a pre-tax basis for certain health care and dependent care expenses. LoginAsk is here to help you access Limited Health Care Reimbursement.

A limited purpose FSA is a great companion to a health savings account HSA which you may use to pay for unforeseen qualified medical expenses. Eligible expenses include certain. 16 rows Various Eligible Expenses.

Employees can deposit an incremental 200 into their Health Care FSAs in 2023.

What Is A Limited Purpose Fsa And How Does It Work Goodrx

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Pairing An Hsa With A Limited Purpose Fsa Further

What Is A Dependent Care Fsa Wex Inc

Five Questions To Implement A Pre Tax Benefit Plan Bri Benefit Resource

Health Care Flexible Spending Accounts Human Resources University Of Michigan

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Fsa Eligible Items Top Tips And What You Can Purchase At A Glance

Compare Medical Fsa And Dependent Care Fsa Bri Benefit Resource

Learn How A Limited Purpose Fsa Works

Understanding The Year End Spending Rules For Your Health Account

What Is A Limited Purpose Fsa And Should You Offer One

Using A Limited Purpose Fsa In Conjunction With Your Hsa National Benefit Services

Navia Benefits Health Care Fsa

Health Care And Limited Use Fsa Human Resources Northwestern University

Flexible Spending Account City Of Burlington Vermont

What You Need To Know About Hsas Hras And Fsas